Jan 04, 2015

Drilling waste management was established in the drilling industry post 1980’s, which is driven by high exploration and production activities, ever increasing stringent government regulations and escalating investments from the oil and gas operators. The trend is set to continue further with the current surge in offshore activities and shale reserve exploratory activities. The global drilling waste management market is therefore expected to grow to approximately $8 billion by 2018, at a CAGR of more than 10% from 2013 to 2018.

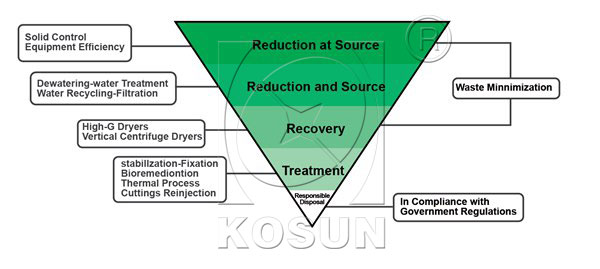

Drilling Waste Management is needed and demanded by the global drilling market. Recently, the market by Services (Solids Control services, Containment & Handling, and Treatment & Disposal), Applications and Geography-Global Trends & Forecasts to 2018 is the new research report available. The appropriate application of waste management principles is essential for both effective drilling operations and environmental protection. Waste streams from drilling, largely include drilling fluids and cuttings that are collected, processed, handled, transported, and disposed.

Drilling Waste Management Process

Geographically, North America and Europe are large markets that grew rapidly in the past decade. These regions are likely to continue to dominate in future. Upcoming markets include South America, the Middle East, and Africa due to recent initiation of environmental policies respectively within the regions.

The report analyzes and classifies the service by applications, services and regions. Market split by application includes onshore and offshore activities within major regions; while the services market is categorized under solids control services, containment & handling services, and treatment & disposal services. Further, the market split by geography includes North America, South America, Asia-Pacific, and the Middle East & Africa.

The report, available for purchase estimates the global drilling waste management market by the intensity of drilling activities and regional and local governmental policies over the waste discharge. It highlights various key industrial issues and market impulse factors. It also describes a number of important dynamics such as drivers, restraints, and opportunities.

Drilling Waste Equipment-Vertical Centrifuge

Drilling Waste Equipment-Screw Pump

In order to provide a deeper understanding of the competitive landscape, the report Drilling Waste Management Market by Services (Solids Control services, Containment & Handling, and Treatment & Disposal), Applications (Onshore & Offshore) and Geography-Global Trends & Forecasts to 2018, includes profiles of some major drilling waste market participants’ market, which combines manufacturers as well as service providers such as Schlumberger (U.S.), National Oilwell Varco (U.S.), Halliburton Energy Services (U.S.), Secure Energy services (U.S.), Scomi (Malaysia), Newalta (U.S.), and Baker Hughes (U.S.).

Market share analysis, by revenue, of top companies is also included in the report. The scope accordingly aids market participants identify high growth markets and helps managing key investment decisions. For this study, major market players are identified through secondary and primary research activities. The market share analysis of these key players is arrived at, based on key facts, annual financial information and interviews with key opinion leaders such as CEOs, Directors, and marketing executives.

Companies profiled in this research include Augean Plc, Baker Hughes Inc., Derrick, GN Solids Control, Halliburton Co., Imdex Limited, Kosun, National Oilwell Varco, Inc., Newalta, Ridgeline Energy Services, Schlumberger, Scomi Group Bhd, Secure Energy Services, Soiltech As, Soli-Bond, Specialty Drilling Fluids, Step Oil Tools, Tervita, Twma and Weatherford International Ltd.